Want to see how long it will take you to save up for a down payment on a home?

This calculator will estimate how long you need to save to reach your down payment savings goal. Enter the current house price, the down payment percent you want to pay, an estimate of rate of appreciation for local real esate, how much you already have set aside, how frequently you plan to add deposits, the amount of your deposits, and the interest rate you expect to earn on your savings.

The calculator will automatically update the results when you change any of the input fields. Home price changes, interest earned & total savings are compounded each time a deposit is made. We also offer a calculator that converts rent payments into equivalent mortgage payments.

For your convenience we list current local mortgage rates to help homebuyers estimate their monthly payments & find local lenders.

Current Local Mortgage Rates

The following table shows current 30-year mortgage rates available in Los Angeles. You can use the menus to select other loan durations, alter the loan amount, or change your location.

How to Save for a Mortgage Down Payment

If you are not yet a homeowner but wish to be one someday, you are going to have to consider a down payment. Though there are certainly some mortgage options that will allow you to get into them without a down payment (like the VA loan, which caters to veterans), these are much more the exceptional cases than the general rule for most home buyers. Workers in influential technology companies with valuable stock options might also be able to bypass saving for a down payment, but this is guide which applies to most of the country.

Mark Cussen, CMFC, has 13+ years of experience as a writer and provides financial education to military service members and the public. Mark is an expert in investing, economics, and market news.

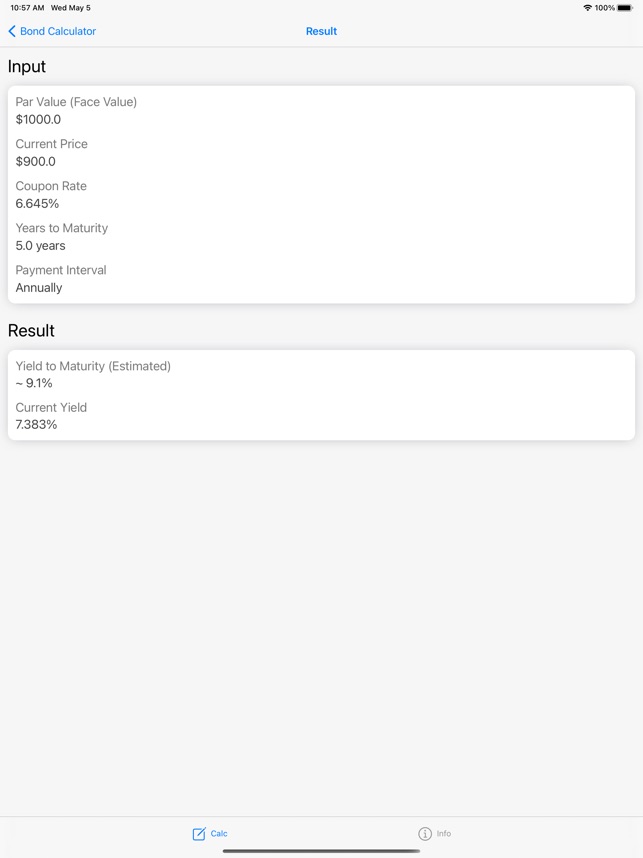

- Aug 07, 2020 Savings Bond Calculator Inventory Instructions Instructions for Opening a Saved Inventory. You can open your existing inventory (if you have one) by navigating to the folder or directory where you saved your list using a file management program like 'My Computer' (for Windows users) or the 'Finder' for Mac OS users.

- What's new in this version. Add Loan Analysis. Add Rule of 72 Calculator. Add Tax Equivalent Yield Calculator. Add US Inflation Calculator. Add Black-Scholes Option Calculator. Add Retirement Savings Analysis. Add Retirement Income Analysis. Add Traditional IRA vs. Roth IRA Calculator. Required Minimum Distribution. Social Security Estimator. Stock Calculators. Bond Calculators.

- The max heart rate calculator exactly as you see it above is 100% free for you to use. If you want to customize the colors, size, and more to better fit your site, then pricing starts at just $29.99 for a one time purchase. Click the 'Customize' button above to learn more!

This article is meant to help you start thinking more clearly about a mortgage down payment: how much you might need, how it affects your mortgage and more. As with all financial decisions, please consult a trusted financial advisor before making any serious move forward.

What is a Typical Mortgage Down Payment?

As there are different types of mortgage options, there are also a range of required down payment amounts to accompany them. Expect to pay from 0-20%, or possibly even more.

Traditionally, 20% was the goal for a mortgage’s down payment but that has shifted some in recent years as lenders and government sponsors get more creative with their offers.

If you are arranging your mortgage through a government entity, such as with a VA or an FHA loan, you could reduce your needed down payment to 3.5% with an FHA, or even zero-down if you are veteran, qualified for the VA loan.

Conventional mortgages usually require a minimum of 5% down, but it will range and vary by provider and the options offered for your specific qualifications.

Freddie Mac now has Home Possible, and Fannie Mae offers HomeReady which are programs created in 2018 with low down payment requirements – only 3-5%.

Factoring in all of the various loan types and programs available, an averaged median cost for a mortgage down payment would currently fall between 5-10% of the full mortgage amount. The optimum down payment is still 20% or more, but lower rates are very common today.

Is Lowest Always Best?

While paying less money to get into a mortgage certainly sounds attractive, it is important to understand how the decision can affect other related aspects of your mortgage's costs.

- Fees: When you pay 5% or less as a down payment, your lender is likely going to leverage additional fees to help mitigate their risk. Some may even bump up your interest rate – so be fully aware of the fees and contingencies based on each decision you make. It is not uncommon for a lender to leverage large fees for each ‘discount’ offered. You should know what each fee is for before signing any loan contract. You should know the difference between discount points, origination points, and other common industry lingo.

- PMI: When you pay less than 20% down, most mortgage providers require Private Mortgage Insurance (PMI) until your loan balance achieves 80% of the home’s original value. PMI fees range between about 0.3-1.5% of the original loan amount annually and are added to your monthly payments. A down payment of 20% negates the need for PMI, so that is why 20% is typically the targeted down payment amount.

Lenders have also become pretty creative in the way they can structure loans, giving more opportunity to folks who have less money up-front to get into a home. One such option, designed to assist cash-strapped borrowers, was the piggyback mortgage of the mid-late 2000's, still used occasionally today.

A Note on Property Mortgage Insurance

Those who pay at least 20% on a home do not require PMI, but homebuyers using a conventional mortgage with a loan-to-value (LTV) above 80% are usually required to pay PMI until the loan balance falls to 78%.

PMI typically costs from 0.35% to 0.78% of the loan balance per year. The annual payment amount is divided by 12 and this pro-rated amount is automatically added to your monthly home loan payment.

| Home Price | Down Payment | LTV | Loan Amount | Insurance Rate | Annual Premium | Monthly Premium |

|---|---|---|---|---|---|---|

| $200,000 | $10,000 | 95% | $190,000 | 0.78% | $1,482 | $123.50 |

| $200,000 | $20,000 | 90% | $180,000 | 0.52% | $936 | $78.00 |

| $200,000 | $30,000 | 85% | $170,000 | 0.35% | $595 | $49.58 |

| $200,000 | $40,000 | 80% | $160,000 | not required | $0 | $0 |

Median Home Prices & Common Down-payment Amounts Across the US

Here are a range of down-payment amounts for median homes across the country. The average amount financed is 90%, so the average down-payment on a median existing home is $23,600 while the average down-payment on a median new home is $38,820. Closing costs are not included in these figures.

| March 2017 Price | 3% | 5% | 10% | 15% | 20% | |

|---|---|---|---|---|---|---|

| Median Existing Home | $236,400 | $7,092 | $11,820 | $23,640 | $35,460 | $47,280 |

| Median Existing Single-Family Home | $237,800 | $7,134 | $11,890 | $23,780 | $35,670 | $47,560 |

| Median Existing Condos & Co-ops | $224,700 | $6,741 | $11,235 | $22,470 | $33,705 | $44,940 |

| Median Existing West Home | $347,500 | $10,425 | $17,375 | $34,750 | $52,125 | $69,500 |

| Median Existing Northeast Home | $260,800 | $7,824 | $13,040 | $26,080 | $39,120 | $52,160 |

| Median Existing South Home | $210,600 | $6,318 | $10,530 | $21,060 | $31,590 | $42,120 |

| Median Existing Midwest Home | $183,000 | $5,490 | $9,150 | $18,300 | $27,450 | $36,600 |

| Median New Home * | $315,100 | $9,453 | $15,755 | $31,510 | $47,265 | $63,020 |

| Average New Home * | $388,200 | $11,646 | $19,410 | $38,820 | $58,230 | $77,640 |

Sources: * Census.gov, all others NAR

Quickly Estimating Down-payments

Rules of thumb for quickly estimating down-payment amounts:

- 10% down: remove the far right number from the home's price

- 20% down: take the 10% number & double it

- 5% down: take the 10% number & divide it by 2

The above rules of thumb will skew slightly low because they do not include closing costs, which typically run between 2% to 5% of the home purchase price.

How Much Money Should I Save for a House?

The more you can afford to put down on a house the less capital will accumulate interest. Further, outside of saving on interest payments, there is another benefit for putting down at least 20%.

For a standard conforming mortgage, it is ideal to put at least 20% down on the loan. Loans which have less than 20% down-payment have a loan-to-value (LTV) above 80% & are required to carry property mortgage insurance (PMI), which is an additional expense paid by the home buyer to insure the lender will get paid in case the homeowner can not make payments. These insurance payments must be made until the LTV falls below 80% & are automatically removed when the LTV falls to 78%.

PMI ranges from 0.3% to 1.5% of the initial loan amount, with the consumer's credit score & the down-payment amount factoring into the rate.

Piggyback Mortgages

If you do not have the 20% down needed to avoid PMI on a second mortgage, lenders have devised a new loan structure to help you get some of these benefits: the piggyback mortgage.

Buyers may apply for a second mortgage to help pay part of their down-payment & remove PMI insurance requirements. This loan format is often referred to as a 'piggyback loan,' where a borrower pays 10% down on the home & uses the second mortgage for the next 10% down to avoid PMI payments.

Where a typical mortgage might be seen as 20-80, with 20% down and 80% financed, a piggyback mortgage splits the down payment into pre- and post- fees, structuring the same amount as 10-80-10 (or maybe 5-80-15, or 15-80-5), with only 10% (or 5% or 15%) needed down, then the additional percentage financed as a different part of the same loan, but a different loan as well…usually at a higher interest rate.

So, you would be making two mortgage payments with a piggyback – one for the mortgage, and one for the down payment – the 80% and that 10% at the end of the equation. But you would need less cash up-front to close.

- The power of this deal lies within the borrower's ability to leverage a lower amount in, and an ability to finance half of the down payment.

- The chief drawback to this kind of deal, is that the second portion of the financing will carry a significantly higher APR – often making this a more expensive option unless you make extra payments.

Losing the costs of PMI will need to be offset by the strategy of a piggyback – maybe by paying off the smaller loan quickly, or this type of loan will not make long-term sense.

While it can help you to get into a bigger home with less money up-front, if you are not careful, a piggyback can actually make you pay MORE for the home in time, than other options would…because the inflated interest rate on the second mortgage could be significant, increasing your bottom line spend for the property.

Should you piggyback? Maybe so, if these are true:

- If you are lacking down payment funds, it makes sense to exhaust all options.

- If you could potentially pay off the smaller loan early, you could certainly benefit from a lack of PMI…but weigh-out the rates and terms to see it all, clearly, to be sure.

Example Monthly PMI Costs

Here is a chart of estimated monthly PMI costs based on a rate of 0.55%.

| March 2017 Price | 3% down | 5% down | 10% down | 15% down | 20% down | |

|---|---|---|---|---|---|---|

| Median Existing Home | $236,400 | $105 | $103 | $98 | $92 | $0 |

| Median Existing Single-Family Home | $237,800 | $106 | $104 | $98 | $93 | $0 |

| Median Existing Condos & Co-ops | $224,700 | $100 | $98 | $93 | $88 | $0 |

| Median Existing West Home | $347,500 | $154 | $151 | $143 | $135 | $0 |

| Median Existing Northeast Home | $260,800 | $116 | $114 | $108 | $102 | $0 |

| Median Existing South Home | $210,600 | $94 | $92 | $87 | $82 | $0 |

| Median Existing Midwest Home | $183,000 | $81 | $80 | $75 | $71 | $0 |

| Median New Home * | $315,100 | $140 | $137 | $130 | $123 | $0 |

| Average New Home * | $388,200 | $173 | $169 | $160 | $151 | $0 |

Sources: *Census.gov, all others NAR

PMI Payments, 30 Year Conventional Mortgage

Years to build 22% equity (& remove PMI payments) for a 30 year conforming loan, based on down-payment amount & loan interest rate.

| Down-payment | 0% | 5% | 10% | 15% |

|---|---|---|---|---|

| APR | Years of PMI payments | |||

| 3% | 8.5 | 7.5 | 6 | 4 |

| 4% | 9.5 | 8.5 | 6.5 | 4.5 |

| 5% | 10.5 | 9.5 | 7.5 | 5 |

| 6% | 11.5 | 10.5 | 8.5 | 5.5 |

| 7% | 12.5 | 11.5 | 9 | 6.5 |

| 8% | 13.5 | 12 | 10 | 7 |

| 9% | 14.5 | 13.5 | 11 | 8 |

| 10% | 15.5 | 14.5 | 12 | 9 |

PMI Payments, 15 Year Conventional Mortgage

Years to build 22% equity (& remove PMI payments) for a 15 year conforming loan, based on down-payment amount & loan interest rate.

| Down-payment | 0% | 5% | 10% | 15% |

|---|---|---|---|---|

| APR | Years of PMI payments | |||

| 3% | 3.5 | 3 | 2.5 | 1 |

| 4% | 4 | 3.5 | 2.5 | 1.5 |

| 5% | 4 | 3.5 | 2.5 | 1.5 |

| 6% | 4 | 4 | 3 | 2 |

| 7% | 4.5 | 4 | 3.5 | 2 |

| 8% | 5 | 4.5 | 3.5 | 2.5 |

| 9% | 5 | 4.5 | 3.5 | 2.5 |

| 10% | 5 | 5 | 3.5 | 2.5 |

If the value of your home increases significantly during the loan, you may be able to get PMI removed quicker than shown in the above charts if the bank recognizes the increased value of your home. To do so, you will have to contact your lender when your LTV is below 80% to request the removal of PMI.

Can You Buy a Home With Low (or No) Money Down?

It is possible to buy a home with little or no money down, however the ability to do so depends on how tight lending standards are, the background of the applicant & the credit quality of the applicant. Some programs are available exclusively to military members, low income communities & first time home buyers.

Conventional 97 Mortgages

Typical banks want at least a 3% down-payment & PMI to insure loans. Loans with a 3% down-payment are called Conventional 97 mortgages.

HomeReady

Fannie Mae has approved mortgage lenders to offer a HomeReady lending program that only requires a 3% down-payment. The program can be used by first-time & repeat home buyers to finance or refinance a home in lower-income & minority-heavy areas. The minimum credit score for HomeReady loan qualification is 620.

Home Possible Advantage

Freddie Mac offers 2 low down-payment mortgage options.

Their Home Possible program requires a 5% down-payment & can be used on most types of property using a variety of fixed & adjustable rate loan terms.

Home Possible Advantage requires a 3% down-payment, but can allow up to 105% financing when combined with a second mortgage. These can only be applied to fixed-rate mortgages on primary residences.

Federal Loan Programs

Some federal loan programs may come with the ability to buy a home with little to no money down.

- VA loans do not charge PMI & do not require a down-payment. Active duty military members and veterans are able to access competitive mortgage rates where the loans are insured by the federal government.

- The USDA's Rural Development loans do not require a down-payment.

- FHA loans typically have a large upfront fee rolled into the loan if the buyer either chooses a 15 year loan or puts less than 22% down on the loan. This fee can be more expensive than PMI, but can save borrowers with poor credit profiles significant money. And after the loan has been regularly paid for years a borrower could choose to refinance into a regular conforming mortgage. FHA loans allow credit scores as low as 500 & only requires a 3.5% down-payment.

What is the Average Down-payment on a House?

Cash Buyers

All-cash buyers represent a small segment of the overall home buying market.

Traditionally most home buyers in the United States have financed their home purchases. According to the National Association of Realtors, in 2016, 88% of home buyers used mortgage financing.

Before many cash-rich buyers from China & other countries purchased escape hatch homes the percent of buyers leveraging financing has historically ranged between 92% & 93%.

Loan Product

A big part of what controls the average down-payment largely comes down to what loan programs are popular at the time. For example, in 2013 the FHA significantly increased fees associated with their loan programs, which in turn has made conventional mortgage loans relatively more attractive & increased the market-share of conventional loans.

Here is the breakdown of buyers by financing type.

| Mortgage Type | % of buyers in 2016 |

|---|---|

| fixed | 92% |

| adjustable | 8% |

| conventional | 59% |

| FHA | 24% |

| VA | 12% |

Demographic Mortgage Data

| Generation | Used Financing | Down-payment | Amount Financed |

|---|---|---|---|

| Gen Y | 98% | 7% | 93% |

| Gen X | 96% | 10% | 90% |

| Baby Boomers | 76% | 17% | 83% |

| Silent Generation | 58% | 22% | 78% |

| Overall | 88% | 10% | 90% |

While a 20% down-payment is a popular benchmark, some borrowers can borrow up to 97% of a home's value with property mortgage insurance, while others leverage federal programs with no down-payment requirements. One of the primary determinants of the percent financed is how old the home buyer is. Here are 2016 home financing statistics based on the age of the home buyer.

| All Buyers | < 37 | 37 - 51 | 52 - 61 | 62 to 70 | 71 to 91 | |

|---|---|---|---|---|---|---|

| Less than 50% | 9% | 6% | 5% | 10% | 19% | 20% |

| 50% to 59% | 4 | 1 | 4 | 3 | 7 | 11 |

| 60% to 69% | 4 | 2 | 4 | 5 | 10 | 11 |

| 70% to 79% | 11 | 8 | 12 | 15 | 14 | 16 |

| 80% to 89% | 23 | 24 | 24 | 25 | 16 | 22 |

| 90% to 94% | 14 | 18 | 15 | 9 | 10 | 2 |

| 95% to 99% | 21 | 26 | 23 | 17 | 10 | 6 |

| 100% – Financed entire purchase | 14 | 15 | 12 | 13 | 15 | 14 |

| Median percent financed | 90% | 93% | 90% | 86% | 81% | 76% |

Time required to save for down-payment

| All Buyers | < 37 | 37 - 51 | 52 - 61 | 62 to 70 | 71 to 91 | |

|---|---|---|---|---|---|---|

| < 6 months | 40% | 38% | 39% | 48% | 47% | 58% |

| 6 - 12 months | 15 | 18 | 14 | 9 | 8 | 6 |

| 12 to 18 months | 9 | 10 | 10 | 7 | 4 | 3 |

| 18 to 24 months | 7 | 8 | 8 | 4 | 4 | 2 |

| over 2 years | 29% | 24% | 27% | 30% | 35% | 31% |

Lender Rejections of Borrowers

| All Buyers | < 37 | 37 to 51 | 52 to 61 | 62 to 70 | 71 to 91 | |

|---|---|---|---|---|---|---|

| Have had application denied | 5% | 5% | 6% | 7% | 3% | 4% |

| Median number of times application was denied | 1 | 1 | 1 | 1 | 1 | 2 |

| Debt to income ratio | 15% | 18% | 20% | 13% | 9% | 7% |

| Low credit score | 14 | 14 | 22 | 16 | 3 | 3 |

| Income was unable to be verified | 6 | 4 | 12 | 10 | 3 | 7 |

| Not enough money in reserves | 4 | 3 | 7 | 3 | 1 | 6 |

| Insufficient downpayment | 3 | 4 | 4 | 4 | 3 | |

| Too soon after refinancing another property | 2 | 1 | 2 | 6 | 4 | |

| Other | 54 | 60 | 36 | 57 | 68 | 67 |

How to Save Smartly

Assuming you are looking at different saving options to try to build-up enough cash to make a down payment, which one will typically pay-off the fastest?

Savings Account

High-yield savings & money market accounts frequently offer under 1% APY while rarely going much above 2% APY (annual percentage yield).

Certificates of Deposit

CDs tend to offer slightly higher rates than high-yield savings accounts depending on their duration. Since the 2008 Great Recession these have rarely yielded much more than 2.5.-3.25% APY.

Bonds

Government bonds typically pay 1% to 3.5% depending on duration, with longer durations paying higher yields. Some municipal bonds are tax free. Corporate bonds typically offer higher yields than similar duration government bonds with the yield spread premium depending upon broader market conditions and the creditworthiness of the borrower.

High Yield Dividend Stocks

High yield stocks can pay anywhere from 3% to 6% per year dividend income, with that number growing over time as dividends are reinvested. Some highly speculative plays tied to cyclical commodities may offer higher yield, though higher yields are often associated with a higher level of risk of either a dividend cut or a fall in share price.

Exxon Mobil paid $3.48 in dividends in 2020, though their share price fell from over $70 at the begining of the year to a low of $30.11 as the COVID-19 crisis swept the globe then Saudi Arabia and Russia increased production in the face of declining global oil demand. Share price volatility does not matter as long as you can ride it out for many years, but a $3.48 dividend would take over a decade to pay for the above share price decline & that is before you account for income taxes on the dividends.

The 2010s decade was one of the worst decades for value stocks in the history of the markets as many offline activities moved online & things like bank branch network and expensive retail stores are devalued by online apps and ecommerce. In the 2020s interest rates are likely to rise at some point, which could cause a shift away from growth toward value.

Sure Dividend offers newsletters and an advisory service to help investors buy into companies they deem stable. There are also high-dividend ETFS like NOBL which allow investors to quickly buy a broad-basket exposure to Dividend Aristocrats.

Broad stock market index

Historically the American stock market has returned 5% to 10% APY with dividend reinvestment, depending on strategy, with risk of significant drawdowns that frequently happen around recessions. Keeping management fees low is crucial to maximize wealth compouding. Most day traders lose money due to selling winners to soon, holding losers too long, and letting their emotions get the best of them. The American stock market is increasingly skewed toward growth rather than value with many large technology stocks making up a big portion of the S&P 500 index.

As you can see clearly, the stock market is where you will earn the most, over time. However, the stock market is full of risks – risks that are clearly diminished in the other options. A CD has less risk, and a savings account sees almost no risk at all to earn its nominal gains. The market, comparatively, fluctuates more often and dramatically than the other investment options will.

Assuming you have a little extra income to save, you will want to find the best possible return for your investment/savings plans. However, this is going to align pretty directly with your aversion or attraction to risk…a higher propensity to risk allows you to gamble more with stocks, less so, and you'll lean harder into CDs and savings accounts.

You certainly may earn more, faster in the stock market, but it is less certain than the other options. The right answer for most people is a balance of assets spread across multiple asset classes.

How Long Do I Have to Save for a Mortgage Down Payment?

According to consumer numbers culled by the Bureau of Labor Statistics (BLS), people in different age groups will tend to save money at different rates.

By their findings, Millennials save an average of $7,624 annually, while Gen-Xers save $12,347. Their data did not accurately reflect Baby Boomers, for it was comparing income to savings and many older boomers did not have a regular income flow to use.

Depending on the size of the down payment, you can do simple math to see how long it might take to save for a down payment. As a Millennial, you are probably looking around five years of saving to get 10% for a moderately priced home today, while a Gen-Xer might take closer to three. It is assumed that Baby Boomers will have more savings and could likely save the money in more like two years' time.

It is important to know all your options, such as piggyback loans, government programs and even the new, historically low APR offers from Fannie Mae and Freddie Mac. Set savings goals and be diligent about paying all existing bills on time, in full.

Also keep in mind that the more you are able to save and put down on your home, the better your terms and costs will be at closing. Though you can get into a mortgage with as little as 5% down today, the fees and costs of that loan could dim or diminish its low-cost entry benefits.

Start Today, Be Ready Tomorrow

The important thing to remember about a down payment on a mortgage, is how it will affect the terms of your deal. The larger your down payment, the less risk the lender feels so better terms and lower fees will be the reward.

Home prices in the US are on the rise everywhere, so getting started early on your savings/investing plans is a shrewd move forward. The best news for buyers, could be that lenders are competitive and eager to offer you the lowest possible rates, which are usually lower than they were historically.

Although it was true for a long time that you needed 20% down to get into a mortgage, this is certainly not the case in the modern mortgage landscape. However, be aware of how having a larger down payment will help you to save money: both immediately, and over time.

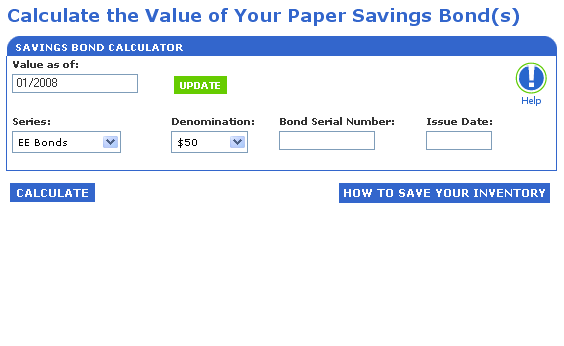

Savings Bond Calculator Software

Talk to a financial planner, start spending more frugally and saving more aggressively, and no matter your age group, you will find a path to home buying success.

Homeowners May Want to Refinance While Rates Are Low

The Federal Reserve has hinted they are likely to taper their bond buying program later this year. Lock in today's low rates and save on your loan.

Are you paying too much for your mortgage?

Find Out What You Qualify For

Check your refinance options with a trusted local lender.

Answer a few questions below and connect with a lender who can help you refinance and save today!

Several internet blogs and videos make false claims that a United States birth certificate is a negotiable instrument (a document that promises payment) that can be used to:

- Make purchases that will be charged to a “Exemption Account” (perhaps identified by your social security number or EIN), or

- Request savings bonds held by the government in your name and owed to you.

The truth is, birth certificates cannot be used for purchases, nor can they be used to request savings bonds purportedly held by the government. Also, the “Exemption Account” is a false term; these accounts are fictitious and do not exist in the Treasury system.

The Story

This story is a variation of the older Bogus Sight Drafts/Bills of Exchange Drawn on the Treasury scam.

The common tale offered in this scam states: When the United States went off the gold standard in 1933, the federal government somehow went bankrupt. With the help of the Federal Reserve Bank, the government became a corporation (sometimes called ”Government Franchise”) and converted the bodies of its citizens into capital value, supposedly by trading the birth certificates of U.S. citizens on the open market and making each citizen a corporate asset (sometimes referred to as a “Strawman”) whose value is controlled by the government.

Scams vary in methods for citizens to gain control of their alleged assets, such as:

- filing a UCC-1 Financial Statement,

- activating a Treasury Direct Account (TDA), or

- creating bonds by using the Savings Bond Calculator.

These blogs and videos promise that your birth certificate bond will be able to wipe out all your debt or help you collect monies/securities. Some internet sites even offer to sell videos, webinars, and coaching on how to do this. No one has profited from the Treasury Department by using these tactics. But, the scammers intend to profit from this story by selling their bogus wares.

The Reality

Savings Bond Calculator Download

There is no monetary value to a birth certificate or a social security number/EIN, and TreasuryDirect accounts must be funded by the owner (through payroll deductions or from purchasing directly from the owner's personal bank account) to have any value.

The Savings Bond Calculator is merely a tool to calculate the value of a bond based on an issue date and denomination entered. This information could be the issue date and denomination from a real bond, or it could just be a random choice of a date and denomination. The calculator only checks that the issue date and denomination entered are a valid combination - it will not verify whether a bond exists. The calculator will not verify the validity of a serial number or confirm bond ownership.

Savings Bond Calculator For Mac Free Software

Ee Savings Bond Calculator Free

Please be advised that trying to defraud the government by claiming rights to bogus securities is a violation of federal law, and the Justice Department can and has prosecuted these crimes. Federal criminal convictions have occurred in several cases. The scam artists who post blogs and videos are trying to defraud you into buying their fake product. Do not fall victim to their schemes.

Comments are closed.